Welcome to the seventeenth edition of the ART AS A CONSEQUENCE weekly briefing. The art world cannot keep away from drama as Damien Hirst got in trouble again. Ron Perelman sold 71 artworks in 22 months - on average letting go of three blue chip pieces in less than 2 years. Also, a great deep dive into Sotheby’s Financial Services (SFS) by Tim Schneider. On the NFTs side the knives went out for Yuga Labs’s Punk in Residence program stabbing straight in the heart and killing Nina Chanel Abney's “Super Punk World” collection. On the positive side, Milady Maker may have landed on the moon. WAGMI. All of that and more below. So, grab a snack 🍎 and happy scrolling.

Lol (lots of love),

Dimitria

Notable news from the art world 🦋✨

🍎 Damien Hirst is in trouble again. Five anonymous sources (who confirmed to either be familiar with or personally involved in the creation process of The Currency series) told The Guardian that many of Hirst’s works from The Currency NFT drop (phygitals) were mass-produced in 2018 and 2019, instead of 2016. According to Heni, the authorized seller of The Currency drop, they state: “The physical artworks were created by hand in 2016 using enamel paint on handmade paper.”

PS. Having worked for Hirst’s Colour Space exhibition that was presented at Gagosian in NYC, similar works were exhibited (for the show work on canvas VS wop) the press release of the 2018 show states: “While the Spot Paintings were originally conceived as an endless series, the Colour Space Paintings are a finite body of work, commenced and completed in 2016.” So Hirst has remained consistent in his approach.

Looking at the auction results for The Currency physicals, the prices range for offerings from last year to now (just within 18 months) with the highest price fetching at auction is $30k (at Christie’s London, February 2023) and the lowest brought in $5k (at Sotheby’s New York, September 2023) - that’s quite a market gap, but shorter and interesting titles fetch higher. This year there have only been seven lots ranging between $8-12k.

The NFT on the other hand is below ETH 1.

🍎 Collector Ron Perelman sold 71 artworks worth $963M to pay down debt after Revlon stock plunged during the early days of the Covid-19 pandemic, recently unsealed court filings show. The transactions took place between 10th of March, 2020 to 10th of January, 2022.

🍎 The Sunday Times Rich List 2024 has been published, revealing the shifting fortunes of many of the UK’s key art world figures. The report adds: “Some names are missing and more may soon be because this year’s edition records the largest fall in the billionaire count in the guide’s 36-year history, from a peak of 177 in 2022 to 165 this year.”

🍎 Tim Schneider wrote a great piece for The Art Newspaper “The Gray Market: Why Sotheby’s $700m art-backed debt security is an acid test for the trade’s intentions”. It explores Sotheby’s USD 700M art-backed debt security, exploring its implications for the art market. Sotheby’s Financial Services (SFS) has a long history of issuing loans backed by high-value art, and this new securitization marks a significant step in the evolution of art finance. By bundling art-backed loans into a large investment vehicle, Sotheby’s has attracted institutional investors, offering them a predictable revenue stream from interest payments or collateral sales.

This move is contextualized against the backdrop of rising art securitization practices, exemplified by Yieldstreet's similar offerings. However, Sotheby’s approach, targeting qualified institutional buyers, dwarfs Yieldstreet’s in scale. The security’s success highlights the growing legitimacy of art as a financial asset, though it raises concerns about the increasing abstraction and financialization of art, distancing investors from the actual artworks and artists. What are your thoughts?

🍎 Photoshop fail of the week? How could this even be approved? The amazing Julie Mehretu for BMW’s 20th Art Car as presented at the Centre Pompidou in Paris.

She looks out of scale in comparison to the car. Her shadow is so artificially placed vs the shadow of the car.

🍎 Lastly, thought of the week: Following the monumental auctions week in NY, it came to my attention that Avery Singer, a phenomenal artist, while now 37-years old already holds an over $5M auction record which was set in 2022. These past days another painting of hers came to the market fetching over $3M. Zooming out, this highlights not only the enduring appeal and growing market value of contemporary art but also underscores the rising influence of female artists in the global art scene. Notably, while younger female artists like Singer are on the rise, male artists such as Gerhard Richter have seen a market decline of 8% and Sigmar Polke a dramatic 30%. Is there a shift taking over?

🚀 🌞🌛 Rise and shine moments from the crypto space

🍎 Yuga Labs’s Punk in Residence program featuring Nina Chanel Abney's “Super Punk World” collection, that intended to merge art, technology, and culture by reinterpreting CryptoPunk traits faced major backlash this week. The community criticized Nina’s work as excessively woke and misaligned with the established CryptoPunks brand, expressing concerns over the dilution of the original collection by Yuga Labs.

May I also add the fact that the artist who stated inclusivity blocked people on Twitter and turned her profile private which added extra fuel to the bonfire:

In response, Yuga Labs decided to halt the program, with CEO Greg “Garga” Solano emphasizing their commitment to preserving the original essence of CryptoPunks and supporting educational initiatives in museums.

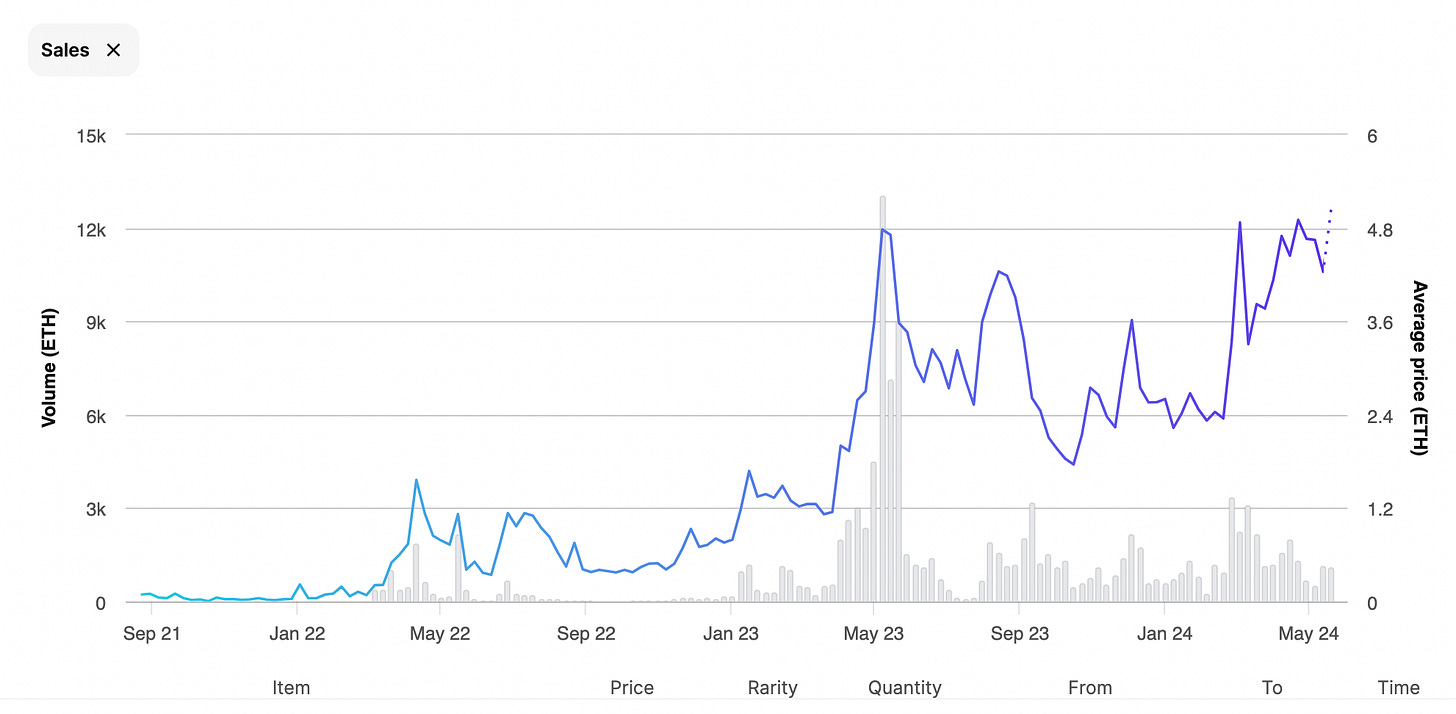

🍎 Milady to the moon: Peaking again at close to all time high ETH 5.8 , while most other collections like Azuki and Mutant Ape Yacht Club declined. This surge, mirrored by the Milady-adjacent Redacted Remilio Babies NFTs, which also rose 35%, occurred despite the typical preference for holding ETH during high volatility. Despite past controversies, Milady and Remilio NFTs have consistently outperformed other Ethereum NFTs since 2022 and are currently at all-time highs, highlighting their resilience and investor interest.

🍒 Bonus: Sunday Movie Night

In this smart, satirical comedy, a brooding avant-garde composer falls for the gorgeous owner of a trendy New York art gallery and the quirky worlds of contemporary art and music are set on a hilarious collision course.

That’s all frens! 👋 toodeloo

See you next Sunday - if there is a next Sunday.

Visit artasaconsequence.net to discover more about my work in the art industry. You can contact me over email or find me on social media: Instagram | X | LinkedIn